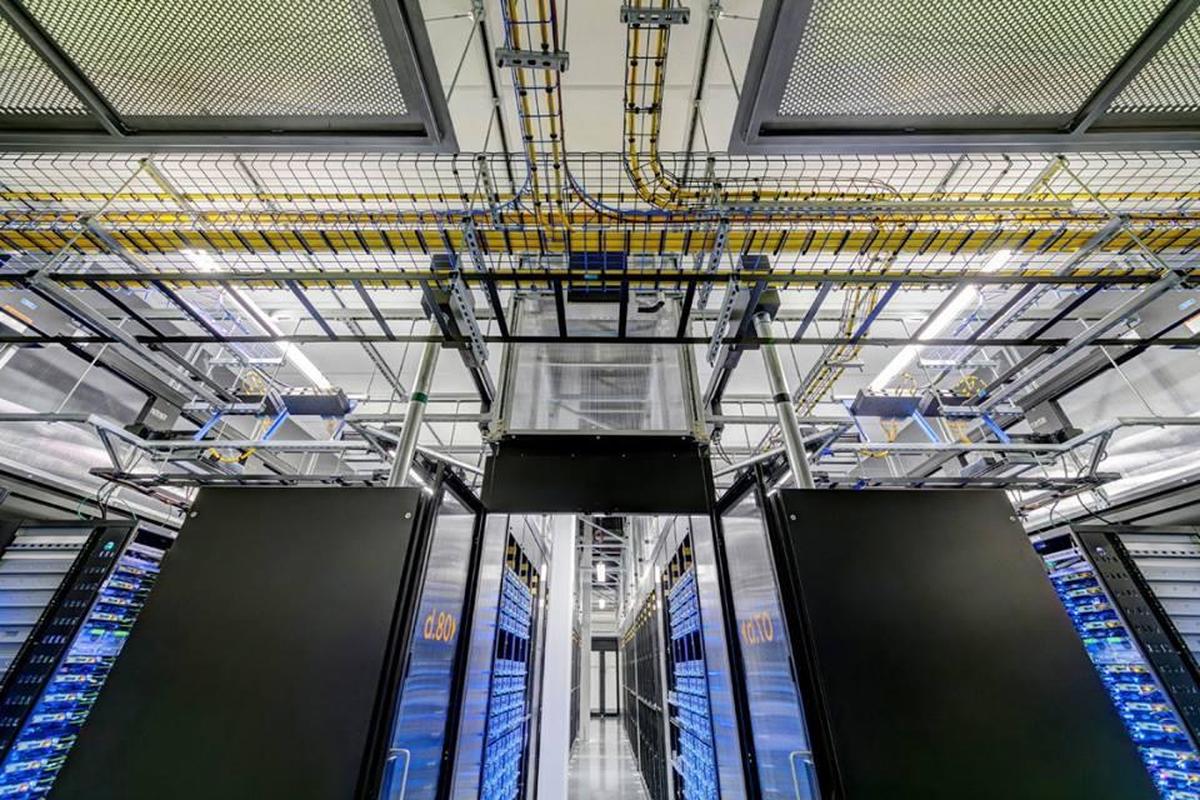

When both residential and commercial real estate markets experienced disruption during the COVID-19 pandemic, the work from home (WFH) culture has increased inclination towards one category of the realty sector- Data Centres. Soon after, India went into a lockdown, Indian data centre market witnessed robust growth of 25-35 percent. And the companies began to revamp their digital infrastructure to deal with the increased data consumption driven by the new work environment. With more and more Indian companies taking a virtual transformation journey, Anarock Property Consultants shared a report- Navigating the India Data Centre Lifecycle – Trends & Perspectives — analyzing the key data centre trends and noted that data centres emerging as the most sought after alternative real estate asset in India. Read SURFACES REPORTER (SR)’s complete report on this:

Also Read: Top Developers to Add 10 Mn Sq.Ft L Into Creating Data Centre Space

As per the report, the data centres have attracted investments of around $396 million from January to September 2020, Anarock-Mace said in a report. Further, it says that the shift is towards large hyperscale develop hyper scale will in turn make the underlying property more valuable.

At least 28 large hyperscale data centres are expected in India over the next 3 years, the report said.

Devi Shankar, who manages the data centre vertical at Anarock, is telling more about the growth of data centres in India:

The COVID-19 induced lockdown has increased the data consumption resulting in the increased demand for internet bandwidth as well as data storage capacities. All companies, government and private sectors including a large number of students started using virtual means to operate their work.

“The COVID-19 lock-downs accelerated the adoption of digital and online mediums, driving huge quantities of data usage. As India shifted to a ‘work-from-home’ mode, virtual, streaming and remote working via digital mode became the norm. Banking, entertainment and education moved online, leading to the demand for data centre businesses to expand exponentially. Initially, a large quantum of Indian data was being stored across global data centres in other countries. The government subsequently brought in regulations, including data protection, data localisation and privacy, which opened up the domestic data centre market,” says Niranjan Hiranandani, founder and MD, Hiranandani Group, and national president, NAREDCO.

Synergy Research Group anticipates that the data centre market will grow at 12 % compound annual growth rate (CAGR) from 2019-2024.

Hotspots for data centres in India

The need for data storage will grow, resulting in a substantial addition to the DC stock during 2020-21, as per to CBRE. This growth would lead to the nation’s capacity crossing 600 MW (megawatts). Leading domestic operators or global players in the cities of Chennai, Mumbai, Delhi-NCR and Hyderabad will dominate the supply chain.

Today, Navi Mumbai has the largest data centre in India, which is Asia’s largest and the second largest in the world.

Also Read: DLF To Invest Rs 130 crore To Build Data Centre in Noida | SR Bulletin

To lower the risk of maintenance, higher power tariffs, high upfront and security costs many private companies are moving from captive data centres to colocation/cloud service providers. Currently, two operating models exist in India that are Captive and Third Party/ Colocation models. Where Captive is a company-owned owned-and-operated service delivery centre, Third Party/ Colocation / Outsourced data centres are those where firms lease the required space and host services from external third-party service providers. The services they offer are mainly server hosting, cloud hosting and VPS hosting. Telecom, BFSI and IT & ITeS are the largest occupiers of colocation facilities.

GOI Policies to Promote Data Centres

Further, Indian government initiatives like Digital India will further spur the development of more data centres in the country. Additionally, the government's emphasis on data protection and self-reliance will further impact its growth. The GOI is itself reliant on data centres for the Government-to-Citizen (G2C) delivery platforms, such as e-visa, National e-Governance Plan (NeGP), and many more.

Also Read: How is the Government Focusing on New Technologies to Empower The Real Estate?

Recently, Finance Minister Nirmala Sitharaman has also announced that the government is planning to roll out a data centre policy enabling the private sector to establish data centre parks in the country. “Data is the new oil” she said. Many state governments such as Maharashtra, Telangana and Tamil Nadu are already offering several incentive schemes for setting up data centre parks in their states.

It is assumed that the 5G technology, which is probably to be launched in 2021 will further push the adoption of Internet of Things (IoT)-enabled products in the Indian market.

Although the data market and IoT are still in their infancy, it has huge potential to be the biggest driver for data centre investments in the Indian market.

Keep reading SURFACES REPORTER for more such articles and stories.

Join us in SOCIAL MEDIA to stay updated

SR FACEBOOK | SR LINKEDIN | SR INSTAGRAM | SR YOUTUBE

Further, Subscribe to our magazine | Sign Up for the FREE Surfaces Reporter Magazine Newsletter

You may also like to read about:

Cover Story: The shifts in WORKSPACE DESIGN & status of Commercial Real Estate

A Pro Infrastructure and Investment Budget Says The Real Estate And Infra Sector | Budget 2021

Developers Devise Online Schemes to Tide over COVID-19 Crisis

10 Pandemic driven design trends that are likely to stay | SURFACES REPORTER Exclusive