With investors stepping up and putting pandemic restrictions behind them, commercial real estate has witnessed the liveliest start to the year. The recently shared data from JLL informs that investments have reached their highest first-quarter level on record in the first three months of 2022. With investments standing at US$292 billion currently, the previous record for the first quarter of US$225 billion was set in Q1 2018. Here is a detailed report by SURFACES REPORTER (SR).

Revival of the sectors

Offices, hotels and retail witnessed a rise year on year in their quarterly investment figures after suffering from the COVID-19 pandemic. Commenting on the revival of these sectors, Sean Coghlan, Global Head of Capital Markets Research and Strategy, JLL, “There’s clearly now evidence of improved sentiment among investors towards those sectors as operational uncertainties diminish.” However, while investment sentiment around real estate improved, it’s not without a sense of caution. Uncertainties in the market are to rise due to the combining efforts of geopolitics, inflation and rising interest rate. The report suggests that monetary policy changes, transport and trade bottlenecks, labor shortages and the demand pressures created by companies looking to either nearshore or reshore would definitely make the real estate sector ponder.

Getting back on track

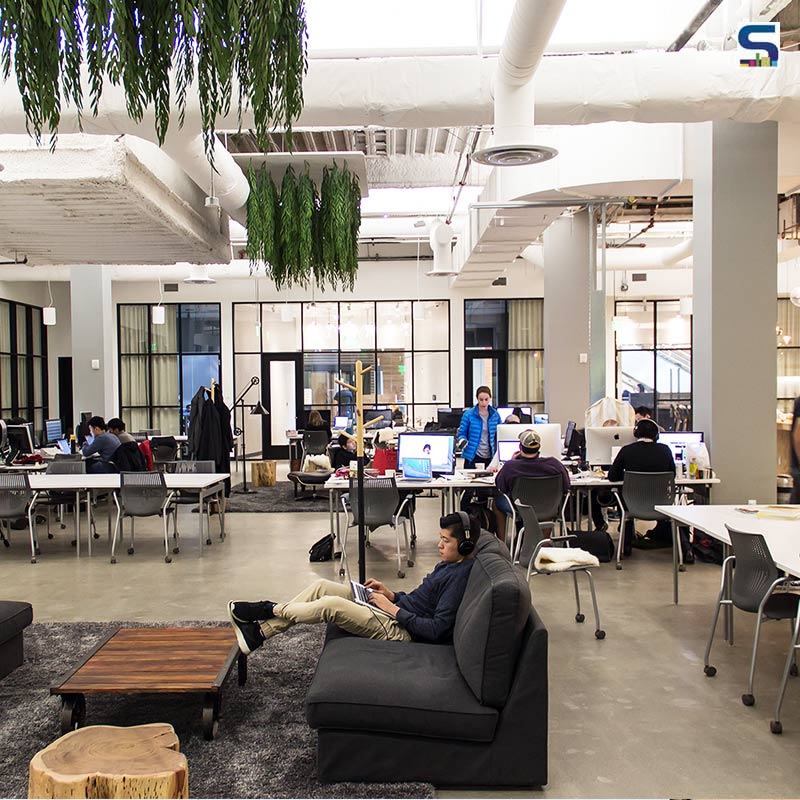

Additionally, some of the positive sentiment has come from a relative return to normalcy. Post lockdowns, employees and companies are getting eager to get back to the office amid the rise of hybrid working. According to JLL, this rising confidence saw a boost in office investment with US$81 billion invested globally in offices in the first quarter – the highest level since 2007. Coghlan adds, “Investors are focused on identifying opportunities in sectors and we’re seeing office investment, for example, approach normalized levels, particularly in Europe.”

Similar confidence is observed in the retail and hotel sectors, informs JLL’s data. Nearly double from the year earlier, the global retail investment volumes were at US$38 billion, while hotel investment reached US$16 billion, up 127 per cent in the same period, according to JLL. Thanks to the improving occupier market, for offices, the global return to favour is large. The office leading demand in the first quarter was marked at 36 per cent – higher than in the same period in 2021 – and reached as high as 44 per cent in the US. Matthew McAuley, Research Director, JLL-Global Insight team, informs that technology companies continue to be a major driver of demand for office space with the tech industry accounting for the largest share of space leased in the US since the start of the year. He further highlighted that the “demand is at its highest for new or best-in-class space, so it’s clear that the flight to quality continues.”

Alongside this, the continued investment in logistics and living sectors drove half of the investment activity in the first quarter in the US. As for logistics, the tight supply of new space is pushing rents higher, with annual rental growth now at 10 per cent globally and in the US and Europe reaching 16 per cent and 11 per cent, respectively. McAuley informed that the new warehousing space cannot be completed fast enough to meet demand despite the record levels of new construction. “That inability to keep up with demand puts vacancy levels in most major logistics markets below 5 per cent.”

With dry powder now estimated to be at US$388 billion, finding a home for capital will continue to be a challenge in 2022. According to an annual survey by real estate fund associations ANREV, INREV and NCREIF, fundraising by real estate investment managers reached a pre-pandemic record high of €254 billion (US$239.5 billion) globally last year. “With many investment funds oversubscribed, where and how capital is deployed remains the critical discussion – but large, mature markets dominate and investors’ flight to diversification and quality continues,” adds Coghlan.

Image credits: Coworking Insights (for representational purpose)